louis vuitton investments | lvmh investor presentation louis vuitton investments In 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard Arnault to invest in LVMH. 4,000mi

0 · who owns christian dior

1 · what brands are under lvmh

2 · lvmh investor presentation

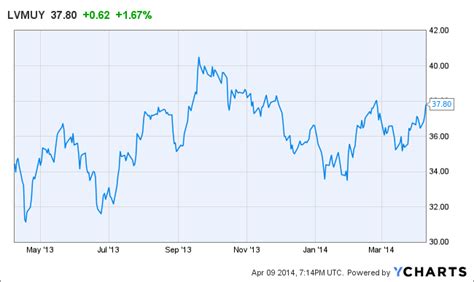

3 · louis vuitton share price

4 · louis vuitton parent company

5 · louis vuitton annual report

6 · is lvmh publicly traded

7 · invest in louis vuitton

75 were here. Hello and welcome to an official page of Crypto Embassy CryptoCash.

EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development .In 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard Arnault to invest in LVMH. Rapidly, Arnault succeeded in taking control of LVMH at the expense of the initial family owners. Contrary to what is often indicated, . Louis Vuitton exceeded €20 billion (.8 billion) for the first time, Celine topped the €2 billion (.2 billion) milestone and Christian Dior gave a standout performance.EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development policy of the LVMH group.

In 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard Arnault to invest in LVMH. Louis Vuitton exceeded €20 billion (.8 billion) for the first time, Celine topped the €2 billion (.2 billion) milestone and Christian Dior gave a standout performance. The significant growth Louis Vuitton is achieving is causing LVMH to open more manufacturing sites every year for the brand in France, where it already has 110 manufacturing facilities and. As chair and CEO of LVMH (Moët Hennessy Louis Vuitton SA), a luxury goods holding company, Bernard Arnault (born 1949) controls approximately 50% of a massive conglomerate that owns more than 70.

With an average value retention of 81%, French luxury giant Louis Vuitton is a safe investment. Using millions of data points on primary and secondary market pricing, demand, and trends, our 2023 Clair Report determined the label’s top five styles in terms of value retention. LVMH shows consistent revenue growth and market share gains, making it an attractive long-term investment opportunity. See why I feel LVMHF stock is a buy. Skip to contentGet the latest LVMH Moet Hennessy Louis Vuitton SE (LVMHF) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and.

LVMH Luxury Ventures, along with other investors, just completed a million investment in Lusix, an Israel-based lab-grown diamond producer.In January of 2016, Catterton, the leading consumer-focused private equity firm, LVMH, the world leader in high-quality products, and Groupe Arnault, the family holding company of Bernard Arnault, partnered to create L Catterton.EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development policy of the LVMH group.

In 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard Arnault to invest in LVMH. Louis Vuitton exceeded €20 billion (.8 billion) for the first time, Celine topped the €2 billion (.2 billion) milestone and Christian Dior gave a standout performance. The significant growth Louis Vuitton is achieving is causing LVMH to open more manufacturing sites every year for the brand in France, where it already has 110 manufacturing facilities and. As chair and CEO of LVMH (Moët Hennessy Louis Vuitton SA), a luxury goods holding company, Bernard Arnault (born 1949) controls approximately 50% of a massive conglomerate that owns more than 70.

who owns christian dior

With an average value retention of 81%, French luxury giant Louis Vuitton is a safe investment. Using millions of data points on primary and secondary market pricing, demand, and trends, our 2023 Clair Report determined the label’s top five styles in terms of value retention. LVMH shows consistent revenue growth and market share gains, making it an attractive long-term investment opportunity. See why I feel LVMHF stock is a buy. Skip to contentGet the latest LVMH Moet Hennessy Louis Vuitton SE (LVMHF) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. LVMH Luxury Ventures, along with other investors, just completed a million investment in Lusix, an Israel-based lab-grown diamond producer.

hermes ouverture

what brands are under lvmh

CreditOn patēriņa kredītam var pieteikties summā no 100 līdz 4000 eiro. Klients var izvēlēties sev ērtāko atmaksas termiņu, no 3 līdz pat 60 mēnešiem, kā arī piemērotāko rēķina apmaksas datumu, un summa tiks sadalīta vienādos ikmēneša maksājumos. Pieteikties patēriņa kredītam iespējams CreditOn mājas lapā.

louis vuitton investments|lvmh investor presentation